402, Samip Complex ,Waghawadi Road ,Bhavnagar

+91 9924194293

info@hugewealthinvestment.com

What Is Peer-To-Peer (P2P) Lending And How Does It Work?

India has always had a culture of people lending money to each other. Be it within business communities where people borrow money to meet working capital requirements or extended families helping each other out in an emergency. Most of this lending is based on trust with no guarantee or collateral to back these loans.

This traditional way of lending, just like every other aspect of our lives, is being transformed by technology. The new modern version of lending to each other is called peer-to-peer lending or (P2P) lending.

In this blog, we will explain in detail what P2P lending is and how it works. We will also answer if you should invest through P2P lending.

What Is Peer-To-Peer (P2P) Lending?

Peer-to-peer (P2P) lending can come in handy during such challenging times. P2P lending works as a much-needed mechanism through which people who want to give loans connect with those who require money. The borrowers pay interest, and the investors/lenders earn interest.

Since the transaction directly takes place between the two parties through a website or application, it eliminates the need for financial institutions like banks to act as the middleman.

Thus, as a source of financing, P2P lending has the potential to extend financial inclusion globally. People with low credit scores or people that lie in the low-income category find P2P lending highly accessible.

With the help of P2P lending, borrowers can get a loan to finance their education, debt refinancing, expand their business, etc. P2P lending is convenient, as you can do it through websites or applications, also known as P2P Lending Platforms.

How Does P2P Lending Work?

These platforms then evaluate borrowers on various aspects. They don’t limit their evaluation to just credit scores. They perform their checks, including the borrower’s employment, income, credit history, etc. Not just that, using technology extensively, these platforms also capture borrowers’ habits through social media activities, app usage, etc.

Based on this assessment, the creditworthiness of borrowers is decided, and they are assigned to different risk buckets. It serves as the basis for how much interest rate a borrower needs to pay. The better the creditworthiness of a borrower, the lower the interest rate for him. And the poorer the creditworthiness, the higher the interest rate a borrower has to pay.

Lenders can check this assessment done by the platform for various borrowers and pick whom they want to lend their money as per the risk they want to take and the return they want to earn. Similarly, borrowers can also see the profile of lenders and reach out to them.

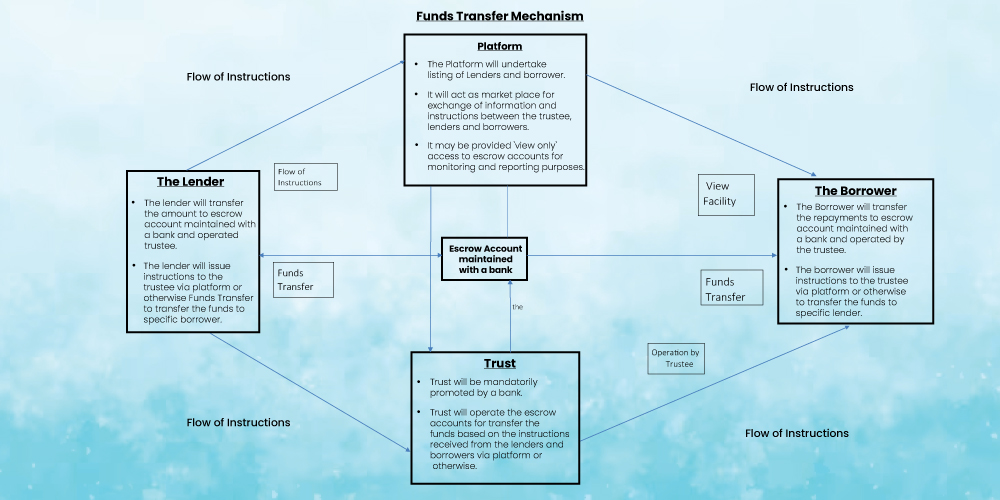

The P2P platforms do not keep a margin from the monthly installments or transactions between the lender and the borrower. Instead, they charge a fee from both for the services that they provide. To make sure that the platforms don’t do anything fishy or fraudulent, like holding on to money invested by the lenders or money paid back by borrowers, RBI regulates these platforms.

How Is P2P Lending Regulated In India?

As the regulator, RBI ensures no systemic risk in P2P platforms. According to regulations, if a platform shuts down, a Business Continuity Plan protects lenders’ and borrowers’ data and ensures loan servicing for the entire tenure. Despite these measures, P2P lending carries inherent risks.

P2P Lending: Understanding The Risks

Since the default risk is the primary risk you are taking as a lender, assessing the potential risk a borrower brings becomes the key.

One argument given to counter the credit risk is that investors can diversify their investments across various high-creditworthy borrowers. While this strategy can help you minimize the risk to some extent, it doesn’t make the investments completely risk-free.

P2P Lending Returns: How Much Can You Earn?

However, there is no industry-wide data to show how much investors can earn from P2P lending. For instance, P2P platform Faircent informs the average portfolio return for the lenders stands at 12-14% for a holding period of one year. Similarly, for P2P platform LenDenclub, the one-year return for the calendar year 2020 stood at 13.47%.

You need to consider two things while looking at the returns from P2P lending are the default rate and the platform fees. That’s because your actual return will get reduced due to these. For instance, if you earn a 20% return from your investment and the non-performing assets account for 5%, your net returns will come to 15%. Say there is a 2% platform fee, then your net return will come to 13%.

Taxation On Returns From P2P Lending

For instance, say, you invested Rs. 1 lakh in P2P lending, and the interest you earned from the principal amount is 15% or Rs. 15,000. If you are in the 30% slab, you will pay Rs. 4,500 (30% of Rs. 15,000) in taxes.

This tax treatment has a significant impact on your final returns. In the above example, your effective post-tax return comes down to 10.5%.

Industry leaders